|

|

Language: |

|

|

||||

| |

Oil price in $20 range and 6 trends for the year

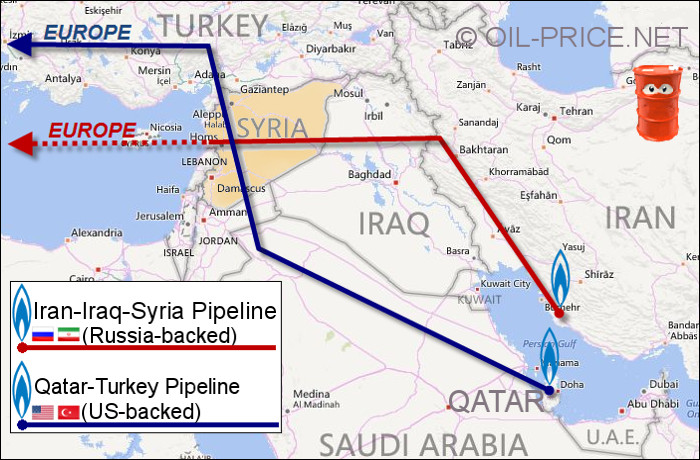

At last, the oil price has fallen in the $20 range. Its rate of decline is all the more impressive, having lost $10 - a third of its value - in one month. Although the price of a barrel of crude oil hasn't reached its all time low yet, adjusted for inflation, of $12.45 from December 1998, it will get there in less than a month if the same downward trend persists. The $20 range for a barrel of crude is unanimously considered inexpensive; to put things in perspective crude oil has become cheaper than the proverbial steel barrel used to store it or even mineral water. The $20 range is also a game changer for many aspects of human life. Undeniably, oil prices have a proclivity for uncertainty. Be as it may, we are going to plough through some of the foreseeable trends for 2016. These trends are based on a combination of historical, geopolitical and economical factors at play. How will these affect the oil prices this year? Iran confronts Saudi ArabiaThe biggest shock likely to occur to the supply of crude oil in 2016 is already in play. Just a cursory view of the headlines of any newspaper in the world during the first week of the year shows that Iran and Saudi Arabia are itching for a fight. This comes as no surprise to us at oil-price.net, because we have been reporting for a year on the hidden war that the two countries have been waging by proxy. The war between Saudi Arabia and Iran has already begun, but they are running out of other countries to do their fighting for them. The tension between these two countries is the latest round in a centuries old conflict between the two main branches of Islam - the Sunnis and the Shia. Saudi Arabia is the chief Sunni nation in the world and Iran is the biggest, and most stridently religious Shia nation. The October article, Oil prices and the Syrian civil war at oil-price.net explained in depth how these two countries have been squaring off against each other for dominance of their region, and of the world's oil and gas supplies. In some aspects, this rivalry, bullying and bloodshed is much akin to the tensions between the US and the Soviet Union during the cold war: both ideological but with strong imperialistic undertones. Both Saudi Arabia and Iran have some of the world's largest oil reserves and use oil revenues to fund their theocratic regimes. Conveniently, big brother Saudi Arabia is the largest oil producer in OPEC, while Iran is the third largest. Involution of religion, power and money is never an innocuous game. Today, Iran is one of the biggest supporters of the Assad regime in Syria pumping in almost $9 billion to prop up the regime. On the other hand, Saudi Arabia is one of the largest providers of arms and ammunition for the anti-Assad rebels. Further, Iran's military has boots on the ground to help defend ally Yemen which Saudi Arabia has invaded in a bloody war with moderate success. This has been going on for some time but 2015 marks a strong escalation. During the 2015 Mina stampede in Saudi Arabia, over 400 Iranian citizens were killed. On January 3rd of this year, the relations between the countries dipped further when Saudi Arabia cut diplomatic ties with Iran after executing a Saudi born Shia cleric. Iran, meanwhile has accused Saudi Arabia for bombing its embassy in Yemen. In the same region, there was another proxy war at play too. Indeed, the Syrian Civil war has its origins in two gas pipelines. In simpler terms, it's like two warring teams competing for the same prize. Both the gas pipelines in question would have crossed Syria to reach the lucrative European markets. The 5,600 km long Iran-Iraq-Syria pipeline, from the Iranian South Pars fields had the potential to reach European markets through Iraq and Syria. Since Russia's state controlled Gazprom sells more than eighty percent of gas to Europe, it supported the $10 billion pipeline as it would have had greater control over gas imported to Europe via Iran, the Caspian Sea and Central Asia. Saudi Arabia, however, did not want the pipeline. Instead, it wanted another pipeline with a North bound route from Qatar through Syria and Turkey (the Qatar-Turkey pipeline) to reach Europe. (Qatar's plans to build a pipeline from the Persian Gulf began in 2009. Qatar's gas field in the Persian Gulf is the largest natural gas field in the world. It is expensive to transport the gas through tankers to other countries.) Since the pipeline bypassed Iran, its ally Assad refused to sign the Qatar-Turkey pipeline as it would have exempted Iran from the picture. And, bitter from the experience Qatar, reportedly, funded anti-Assad rebels by injecting billions of dollars. Money, gas and religion segued into a bloody conflict.  Increasingly, sliding oil prices have put significant political pressure on Saudi Arabia as the kingdom is showing amplified signs of panic: public executions are at an all time high and it serves two purposes: to intimidate any thought of rebellion and to please ultra-conservatives as these executions only target journalists and poets whose lifestyle is frown upon by Sunni fundamentalists. Unfortunately, these acts only embolden Islamic hardliners, and encouraging fundamentalists. A recipe for disaster, it seems, in this volatile part of the world. Saudi Arabia's oil dependent economy is in doldrums. The kingdom's decision to increase production to take out competitors like Iran and US has backfired with falling crude oil prices. The US and Saudi Arabia are strange bedfellows. However, the relationship between the US oil lobby and Saudi Arabia is a different toss altogether. Historically, they've always enjoyed a cosy warm relationship with mutual benefits. Things have changed with what's increasing being seen as 'backstabbing' of US oil producers by Saudi Arabia. The stab has cost Saudi Arabia a political strong ally which could have steered US's foreign policy away from Iran in the Middle-East. With Saudi Arabia out of favor with the US oil-lobby, it comes as no surprise that the US is buttering up to Iran while showing the backdoor to Saudi Arabia. Iran, on the other hand, has pledged to reduce its stockpile of uranium (under the watch of IAEA) and the sanctions against Iran have been lifted. Though sugar coated in the name of 'peace and security' of the world, the main reason for the soft policy towards Iran is to choke up Saudi Arabia. With the waiving of sanctions, Iran's isolation from the world stage will end, with a much needed freedom for its exports especially oil. Already, Iran is planning big with new energy projects with a boost to oil production. The new supplies from Tehran will be an added headache for Riyadh. Iran is expected to usher in 500,000 barrels of oil per day to the market initially, then ramp up to 3.7 million barrels by the end of 2017. As Saudi Arabia's oil sector contributes almost all of its state budget, the loss due to plummetting oil prices is much pronounced. In 2015, Saudi Arabia liquidated $96 billion, 1/5 of the country's wealth reserves to sustain domestic subsidies and welfare programs but is still unable to use its largely unemployed population into anything productive despite having no income tax. A mere 4% of Saudis work in the private sector, a paltry figure often attributed to the Saudi's cultural aversion for work. In 2016 things will get worse for Saudi Arabia as Russia puts pressure on ISIS in the Syrian theater. In fighting various rebel groups including ISIS, Russia has adopted the strategy of 'funnelling'. Following this the tactic, Russia is indiscriminately targeting all rogue elements that oppose the Assad regime an all fronts, except those in the South. That way, fighters are funnelled to the southern path of least resistance towards Saudi Arabia. As ISIS heads to Saudi Arabia, Russia's funnelling policy is already at work, a smart move from Russia since it was Saudi Arabia's own initiative to fund the overthrow of Assad in Syria. Shall we say, this 'funelling' has all the NATO allies fairly nervous? Maybe it's time NATO picked up better friends and allies (we're also looking at you, Turkey). Meanwhile embargoed Iran has been able to develop a somewhat self-sustaining industrial and services sector. Iran is on a better path to self-reliance and will aptly gain more favors from the West in the future than Saudi Arabia rushing towards bankruptcy while openly funding terrorism. Iran has a wider range of industries that's more appealing to foreign investors. By contrast, Iran designs and builds its own submarines, tanks and helicopters, while Saudi Arabia can't be bothered to even refine its own gas - indeed, Saudi Arabia, one of the world's largest exporter of crude oil actually imports gasoline! Granted Iran is far from perfect but for now at least, as the Middle-East goes, Iran stands as the sexiest horse in the glue factory. But the Iranians and Saudis are not blinded by their hatred of each other. Ironically, both need the Persian Gulf to remain navigable if they have any hope of selling enough oil to fund their war. The prospects of mutually assured destruction of the oil output of both countries means that they are unlikely to clash across the Gulf. However, a military conflict between the two on Iraqi territory seems inevitable - whether directly or through proxy fighting groups like ISIS. Much like the US and Soviet Union during the cold war there will be more "proxy" confrontations and they may attempt to coerce their western allies as Saudi Arabia has done in Yemen. For now, the animosity between Saudi Arabia and Iran means they are unlikely to come to an agreement regarding oil quotas and will pump more oil to fund pressing economic and military needs. With both sides pumping out oil to fund the war, the increased availability of crude on the market caused by Iranian and Saudi competitive selling will drive the price back down and below its current levels. Expect oil to head down to $20 during 2016. WTI oil price exceeds Brent oil priceRecently, the US lifted a four decade ban on oil exports put in place after the Arab oil embargo of 1973. Now, thanks to the shale boom, oil producers can export US crude oil and condensates to markets around the world. Though the infrastructure to take the oil across countries in Africa, Asia and Europe are still in the nascent stages, there's much going for the US oil. Already, the first shipment has left the port. US WTI (West Texas Intermediate- main benchmark for oil consumed in the US) crude oil is quite attractive compared to other oils. Physically, it is lighter and has less sulphur than Brent crude oil, which is an International benchmark. (Brent crude oil futures contracts account for about sixty five percent of globally traded oil futures.) With an API gravity of 39.6, WTI is lighter than Brent whose API is 38.6 (API gravity is a measure of how heavy or light a liquid is compared to water). Gravity is inversely proportional to density, so a higher gravity means the liquid is lighter (Water has an API gravity of 10 so anything over 10 means it is so light that it can float on water). "Sweet" crude has low sulfur content. The delineation point is a 0.42 per cent sulfur content. Crude oil with sulfur higher than this point is called "sour." Lower than 0.42 per cent is termed "sweet." Both WTI and Brent are sweet with Brent having a 0.37 per cent sulfur content and WTI having 0.24 per cent. Hence WTI is often referred as "light sweet crude". Low sulphur means it's easier to refine and, further, WTI produces more oil during the refining process. So, understandably, it has to be high on the preference table for refiners. Burning fuels with sulphur causes pollution so a crude oil with more sulphur means an expensive and dirty process of sulphur removal. Crudes can be as viscous as tar. For low-wax WTI, comparatively, the low viscosity allows it to flow better through the assortments of pipes in a refinery. Yes, Brent is also light but not as light as WTI. So refining one barrel of WTI is cheaper overall than one barrel of Brent. Further, another advantage going for WTI is that Brent comes from old and declining basins while WTI is more widely sourced to Cushing. However, in normal circumstances, Brent, from the North Sea, is referenced in almost two-thirds of all crude contracts and trades higher than WTI. This is entirely due to the ban on exporting WTI. Now that the ban has been lifted expect higher quality WTI to increase compared to Brent in price. Historically, there's always been two or three dollar difference between the two benchmarks. But towards the end of 2015, the price of WTI closed up on Brent's crude oil per barrel. To put it in perspective, the trend of WTI overtaking Brent was seen in 2014 and 2010 too. But the factors are different now with the lifting of the oil export ban. Unlike Brent, WTI is more expensive to ship as the supplies are landlocked and the crude oil has to be transported by pipelines. Last month, the US oil production stood at 9.2 million barrels a day. The United States, also, has more crude oil reserves than ever since the 1930s. Yet, with the lifting of the export ban, the benchmarks of WTI and Brent are going neck and neck. Steadily, WTI is becoming one of the most traded oil benchmark. The removal of the export ban should erase the price distortion between WTI and Brent crude. Thus, the American benchmark pricing index should rise to match the Brent index. Given WTI's more attractive properties than Brent crude, WTI will likely move permanently higher than Brent during the next few months. By our estimate at oil-price.net the price of WTI exceed the price of Brent by up to $5 during the course of 2016. Precision Horizontal drilling, American IngenuityBack in June 2014, when oil prices were around $115 per barrel, investing in shale oil drilling, with its breakeven point of $70 per barrel seemed a no-brainer. The "tight oil" producers would roll into town, offer millions to farmers for drilling rights, and bus in highly paid rig hands who would outbid each other for the sparsely available local accommodation. The sudden fall in the price of a barrel of oil soon shook out the high-rolling land-grabbers, and the accountants moved in to trim the fat. Many believe that Saudi Arabia intentionally dropped the price of oil to squeeze out the shale oil producers in the United States. By the beginning of 2015, the price of oil had halved from its peak down to $55 per barrel. The shale oil producers didn't go away. However, there was a momentous shift in the sector. Back in 2013-2014 the average investor calculated on a $10 financing cost on top of the various costs of drilling for shale oil at $70 per barrel. Therefore, oil prospectors were a one way bet as long as the oil price stayed above $80. A fall below that level focused scrutiny on the industry. Some producers had been investing in innovative techniques, drastically reducing rig set up times and slashing costs. Those who carried on with the simple Gold Rush methods went to the wall. Lower oil prices brought normal market forces to bear on the tight oil industry. There were winners and losers. Predictions at the beginning of 2015 expected the year to be the swansong for US shale oil. All those predictions proved wrong. Predictions for the demise of tight oil production during 2016 will also be proved wrong - thanks to horizontal drilling. Throughout 2015 you may have read that the rig count in the US was plummeting. This was seen as evidence that shale oil producers were going out of business and that US oil production had a one way ticket to oblivion. In fact, rather than being an indicator of the demise of the shale oil industry, it was an explanation of its survival. Much of the cost of drilling for shale oil occurs during the start-up phase. Gaining permits to drill involves environmental impact studies, consultants and lobbyists to attend scrutiny meetings of interested parties and regular attendance at the state legislature to get the permit passed. If opposition pressure groups launch legal action to try to prevent drilling, then there are lawyers' bills to pay as well. A new drilling site needs services connected. Good access roads have to be built, experience staff have to be sourced, enticed, transported and housed and water lines need to be extended to the site. Back in 2013 and 2014, frackers extracted only a percentage of the total oil reserves beneath their rigs. This is because the geological strata in which the oil is trapped is often buckled and fragmented, meaning that all of a band of shale cannot be accessed by one vertical rig. This situation required redrilling, down time, idle workers and expensive equipment. The application of horizontal drilling has removed the need to keep drilling new wells, thus the fixed start up costs of a rig can be repaid over a much higher output. This is how frackers have slashed their costs and dropped their breakeven point. This is also why the headline rig count plummeted during 2014 and 2015. Analysts now calculate that the breakeven point of new shale oil wells is $25 per barrel, not counting financing costs. Low oil prices cause corporate bonds defaultsFracking relies on a "treadmill" of wells in various completion stages to make up for the high depletion rate and maintain a steady output. Wells are expensive to drill, but there is a wide range of up front drilling costs. In the Mississippi Lime of Kansas, drilling and completion costs come at around $2.8 to $3.5 million per well. In North Dakota's Bakken area, that figure is around $8 million. The vast majority of shale oil extraction costs occur before oil starts to flow. Back in 2013 when oil prices were nearing $115/barrel, drillers had no problem borrowing billions to fund well drilling. Their endeavors were backed by the huge profits between a $70 cost to extract a barrel of oil and the $115 price on the open market. The shale oil industry has attracted an estimated $350 billion over the last 6 year, and most of those funds were raised through corporate bonds. In the low-yield world of Quantitative Easing, fixed income investors turned away from government bonds, looking for better returns, and the interest rates offered by the tight oil industry were attractive. In 2014 an estimated 20% of the total US stock market was in energy-related activities. That's how big the hay days were. However, the great strides in efficiency gained by the industry over the past year have come only partially from the adoption of new technology and techniques. The lowering average breakeven point of shale oil wells has been greatly assisted by the least efficient drillers going out of business. The fittest have survived. Those who back the losers have lost their savings. To protect themselves small producers have suspended operations. Well heads are in standstill and will resume operations once oil prices go back above a certain level. Many energy companies are selling their assets and cutting their spending costs. Some have issued new shares to stay afloat and some have filed for bankruptcy. In addition, some land leases contracts require that the well remain in operation. In order to maintain their lease obligations some producers need to keep extracting a nominal amount of oil each month and sell them at a loss. This contributes to the oversupply and keeps oil prices down. Meanwhile small producers operate at a loss and banks are unwilling to be underwrite new bonds. The rating of such bonds become "junkier" as oil producers are perceived more and more unlikely to repay those loans. Investment funds specializing in high-yield corporate bonds are heavily invested in oil-debt, and they are starting to feel the chill that is biting at the less profitable end of the industry. Tight oil corporate bonds are now being classified as "junk," and the hedge funds and investment trusts that hold those bonds are in trouble. Last month, Third Avenue Focused Credit Fund closed down, in an action that is known as "shuttering." Investors are prevented from taking their money out, but have to wait for the fund to liquidate and pay out each saver his share - which will be considerably less than the investor's initial stake. This is the third oil bond investing fund to shutter. We at oil-price.net estimate that the default rate on oil bonds will double over 2016. Other analysts have estimated that 50 per cent of junk-rated US energy bonds will default. That amounts to a total of $180 billion wiped off the value of American savers. Worldwide, energy companies and miners have raised a total of $2 trillion in debt through bonds. If 50 per cent of those default there is another 2008-style crash on the way. To make matters worse, the recent rise in interest rates by the Federal Reserve marks an end to the low-interest era for government bonds and compel investors require a risk premium over and above what they can get in government bonds, so they will abandon corporate bonds that can't offer higher interest rates backed by convincing financial data on the company's viability. These figures and events mirror the pre-conditions that led to the 2008 credit crunch. Ironically, although the US shale oil industry will survive lower crude oil prices, the banks and investors that funded the surge to efficiency may be ruined by it. Europe's southern front breachedThroughout 2015, hordes of war-hardened middle eastern men have marched and settled into Europe in search of generous welfare handouts. Unlike typical refugees (women and children) these are mostly able-bodied men exiting a theater of war. As European citizens gaped in disbelief, over a million of these men entered Europe with little or feeble resistance from the police force and no military opposition whatsoever. Recent events have shown these migrants were quick to self-organize in groups combing the streets of major European cities and harrassing unveiled European women, like a makeshift religious police. As expected, sexual crimes against women are on the rise throughout Europe. With little or no education, mired in ancient beliefs these welfare migrants are intent to stick to same customs that brought the Middle East to its knees - opposite to European secular values of gender equality. To add insult to injury, European taxpayers are footing the bill of their welfare which many migrants perceive as a deserved 'islamic occupation tax' while terror attacks become a common occurence. Early on we repeatedly warned that Europe's migrant crisis will significantly and irreversibly undermine intra-European commerce and security. Of course we were right and what we presaged is now unraveling. If history is anything to go by, we are witnessing a situation similar to what happened in Lebanon forty years ago. Then, Lebanon was dynamic, prosperous and thriving with a western outlook in lifestyle and trade. Tourism and banking aided the prosperity. Lebanon had a strong Christian presence and a secular government. Unsurprisingly, Beirut was considered the Switzerland of the Middle East. But in the early 70s, 400,000 Palestinian refugees had settled in neighboring Jordan as a result of the war with Israel. The refugees took to fighting swayed by extremist ideologies. The king of Jordan evicted the refugees and they moved to Lebanon. Soon enough, they started to undermine the secular political system of Lebanon. The refugees insisted on maintaining their system of sharia law, in a sort of 'a state within a state'. Once islamic presence grew to 30% of the overall population, muslims began enforcing new rules in definance to the secular society. Tensions mothballed into a full-blown conflict soon after and some leftists joined muslims in what they candidly perceived as a "class struggle". In the 1975-76 civil war countless were killed and the effects are still felt. Meanwhile Lebanon has become yet another middle eastern basket case. According to the International Organisation for Migration (IOM), the migrants and refugees crossing into Europe breached the one million mark mid-December 2015. With instability and war back home, between 8 and 20 million more are waiting on the wings to cross into Europe. To make matters worse, European leftist governments - much like the Lebanese 40 years ago - demonstrate no intention to protecting their native population and in typical socialists unconditionally side with the underdog. What's worse, the only pan-European agreement reached so far is to outsource border security to Turkey, the largest human smuggler of jihadis to Europe, at the tune of 3 billion Euros. In 2016, if all these refugees beach on European shores a Lebanese style debacle is waiting to happen - a shattering of political system with the reward of instability. Some of the least populated (under - 10 million) countries including Hungary, Sweden, Austria, Bulgaria, Denmark, Finland, Slovakia, Croatia, Lithuania, Slovenia, Latvia or Estonia are most at risk of facing a Lebanon-like situation where massive sudden migrations will easily overwhelm a local population. The tightening of European border will lead to a decline in intra-European exchanges and rampant distrust - bad for business. Additional taxes will come into place adding to the already worsening economic climate. Europe had a strong oil demand last year. However, we expect Europe's oil consumption to decrease a drastic 5% in 2016, freeing additional oil to the open market daily. This will contribute to a decrease in oil prices. Petro-Yuan is bornThe brain child of former Secretary of State Henry Kissinger and Saudi Arabia, the petrodollar was created in the early 1970s. In exchange for political and military security from the US, Saudi Arabia began to sell oil only in U.S. dollars. In fact, the Saudis had pegged their own currency to the dollar. Thus, the US had vested interest in Saudi Arabia as they needed that co-relation between dollars and oil. Historically, crude oil contracts are settled in US dollars. In other words, if you wanted to purchase crude oil, you needed dollars. Thus, the oil importing countries bought dollars and oil exporters sold their oil for dollars - again. Of course, exporters then purchased more dollar denominated assets, boosting the strength of the currency. A circle! Naturally, dollar dominated as the global reserve currency. It allowed the US to chug along, in spite of the deficit, largely because of the world's insatiable thirst for dollars- and oil. In a way, the USA's largest export is the US dollar. Changes do come, don't they? For petrodollar, the change came in 2015 when Russia's state owned Gazprom agreed to sell oil to China for Yuan instead of the usual dollars. Then on November 13th 2015, the IMF added the Chinese Yuan to its basket of reserve currencies, giving the Yuan the highly-regarded international status of "Reserve Currency". In early 2016 China has already purchased a vault capable of housing 1,500 tons of gold in London. Despite the slowdown in the Chinese economy, the Chinese Yuan is emerging as a strong contender to the US dollar. The plans are gigantic, fit enough for a giant country. China is all set to launch a new crude oil contact at the Shanghai International Energy Exchange that would be priced in Yuan. Since China is the world's third largest buyer of oil, the development is worth noticing. Is it only incidental that Saudi Arabia is also the largest provider of oil to China? This year will see the first stab at petrodollar by China. One of the main advantages of the Yuan is that it's not a floating currency. In other words, China can (and does) set the value of its currency without much accountability. This currency manipulation has allowed China's manufacturing sector the undercut every single industry in the world and is the single most important reason China has achieved such growth. Since, it's working for the Chinese why would they discontinue- you have to ask. Certainly, 2016 will see China settle oil payments in Yuan with various African countries. With a robust manufacturing industry, China will push the African countries to use Chinese Yuan to buy goods directly from China cutting the US banking system out of the loop. Already, more than a dozen countries settle about ten percent of their trade deals with China in Yuan. Apart from Russia, Canada's usage of Yuan is also steadily increasing. Almost thirty two percent of China's $4 trillion foreign exchange reserves are invested in U.S. government debt. It's natural that China wants to shelter itself from any future risk. Since there is a staggering amount of oil in the world at present, there is no real contention for this overabundant resource. So, the time is just right for China to nibble away the dominance of dollar. Petro- Yuan could be one of the biggest but under-reported and discussed threat to the US economy.

In conclusionOil prices fell on a combination of factors: competitive overproduction outstripping a steady global demand and weakening of OPEC. From a peak $115 a barrel in August 2014, the oil prices have steadily fallen. (Good for consumers and bad news for the oil industry, to be sure.) The oil production, though, has grown by 2.8 percent to average 96.2 million barrels a day, which is the largest annual increase since 2004. Figures from October, put the inventories in the Americas, Europe and Asia at 4.4 billion barrels compared to 3.8 billion barrels in the last five years. While we forecast that the global oil demand will increase by 1.3 million barrels per day this year, how the prices will move in the future shores up more questions than answers. In a nutshell, the geo-political tension, oversupply/undersupply of oil and weak/strong demand will together decide the direction the oil prices will roll. This, you should know, is never simple as the oil market is fleeting, fragile and contradictory. Remember, it's never about one foretaste or particular factor. Be sure, a tight supply in oil, whatever be the back-story, is capable of sending the oil prices North in no time. Russia is facing recession but is yet to cut oil supplies and there is always OPEC to sever the glut. The watchword is 'weariness'. Obviously, the oil prices are 'perceived' low, yet to put things in perspective they are nowhere near the adjusted for inflation all-times low of $12.45 a barrel from 1998. Clearly they can go lower. | ||

|

© oil-price.net 2009, all rights reserved. Permission to redistribute articles from oil-price.net on other sites can be obtained by contacting us. Redistributed articles must contain a copyright notice and a link back to http://oil-price.net as follows:

| ||

|

|