|

|

Language: |

|

|

||||

| |

9 oil price forecasts during Trump presidency

We're on a roll when it comes to accurately predicting major geopolitical events and their impact on oil prices. In our article titled Takeover of Oil by Militias" published in 2012, we successfully anticipated that Islamic militants (ISIS) would use oil revenues to fund the formation of their own theocracy. In 2013, in our article titled "OPEC and oil prices - is the story over" we, rightly, predicted that Saudi Arabia's failure in ensuring that OPEC countries adhered to the quota system as well as the reference prices would cause the cartel to crumble and become irrelevant. Also the same year, by mathematically analyzing the evolution of oil prices, we predicted high volatility ahead. As it turned out, oil prices plunged 40% a few months later. Clinchingly, adept at it, we also surmised that a disagreement between Russia and Saudi Arabia over a planned gas pipeline would lead to the Syrian civil war, which we also detailed in later articles. In May 2015, while crude oil was hovering at $50 from the previous high of $115 in June, we warned our readers that it would plummet further. Within a few months oil prices fell to the $20s. See, with that track record, you may pardon us for bragging. Anyway, when it comes to oil prices, the oil industry and geopolitics, here are 9 predictions for the next 4 years regarding the geopolitics of oil under President Trump. 1. Lower oil pricesDonald Trump managed to win the presidency in spite of spending only half as much as contender Hillary Clinton. In other words, despite popular belief that "money buys votes" he is on the saddle now and got there for less. In business terms and like the true businessman that he is, Donald Trump won by delivering the goods for much cheaper than the competition. This philosophy which he brings along to the White House will have tremendous repercussions on oil price and the energy industry. The moot point is that Trump is pro-drilling. As a matter of fact, there are many more untapped shale pockets waiting to be explored in the US. In fact, many of those sites lie in places already on the fracking map like Oklahoma, North Dakota and Texas. That should make things easy. After all, to put things in perspective, it was hydraulic fracturing and horizontal drilling that put the US firmly on the path towards energy security. Further, Trump may also end the moratorium on drilling in Alaska, while easing oil exploration in the Southeastern Outer Continental Shelf (OCS). Trump's 'America First' plan will reverberate on the energy corridors too. With the House now on his side, nothing stands in the way of Trump delivering on his promise to run the United States of America like an efficient, competitive business. And all that new oil barreling down into an already oversupplied market means low oil prices. Crude oil which fuels and lubricates the proverbial gear train of the American economy is guaranteed to come down and stay low in terms of price. 2. Keystone XL pipelineA major objective on Trump's agenda, construction of the Keystone 'XL' pipeline will finally see the light of the day in the coming months. Before delving further, what's Keystone XL pipeline, anyway? Keystone XL is actually the fourth phase of the Keystone project that began in 2005. The proposed 1,180 mile long pipeline will carry about 830,000 barrels of oil per day from Alberta, Canada to Steele City, Nebraska. Indeed, the Keystone pipeline already transports oil from Canada and the XL line would have increased the inflow of oil. In keeping with the philosophy of running a business efficiently, the XL pipeline will replace crude oil transportation by train - an expensive, inefficient and accident-prone operation - with, well, a pipeline - an alternative both cheaper and more ecological if one really cares to see beyond party line rhetoric. Yet, the pipeline is still a chimera. So what's causing the massive opposition to the Keystone XL project? Well, President Obama put the project on hold as the pipeline would have passed along fragile ecosystems. Also environmentalists argue that extraction of oil from oil sands (like in Alberta) consumes more energy and causes more contamination to the environment than conventional drilling. The election has shifted everything. Easily and quite visibly, Donald Trump will remove the roadblocks on the path of the Keystone XL project. TransCanada, the company behind the pipeline is going to reapply for permits. So, with the presidential permit, the oil will cruise along to enrich the US. Effectively, the pipeline will flood the US market with cheap Canadian crude oil, to the delight of US refiners and dismay of US producers who will see the price of WTI oil - and their profits - come down. According to the US State Department, the proposed project could generate 42,000 jobs spread over a period of two years. But after the pipeline is built, any net long-term job growth will likely be north of the Canadian border as US producers profits - and payroll - shrink. One benefit of the pipeline is, of course, security. By shifting crude imports to our friendly Canadian neighbors to the North and away from Gulf states, the fewer dollars end up funding the export of Islam fundamentalism. Thanks to the pipeline, import of crude from Gulf States - and the financial influence of Gulf States, notably Saudi Arabia on US politicians - will be reduced as well. More the oil, lower the prices. 3. Divided oil industryTo sum up, Trump's presidency will increase contentions in the oil industry because some stand to win and others stand to lose. It's a race out there, we tell you. The winners are refiners and consumers as the focus shifts to a pro-infrastructure revolution. Yes, we'll explain. The refineries in the US, to a large extent, have failed to catch up with the remarkable surge in domestic oil production. Lack of pipelines to transport crude to the refineries is costing the country and how. Production of crude oil has risen from 5.6 million barrels per day in 2011 to 9.4 million barrels a day in 2015. Our own forecast at oil-price.net for 2016 is 8.8 million barrels per day. Much of the domestic oil production coming from low permeability formations in Bakken, Eagle Ford and Permian Basin are Light Tight Oil (LTO). Yet, most of the refineries are calibrated to process the imported medium to heavier crude. Technically, it's possible to recalibrate the refining process to process light crude. Hence, if some onerous tasks in the infrastructure are removed, the consumers stand to gain. Now, let's look at the loser's side of this argument. Unfortunately, it's the oil producers. Fracking is an expensive process. In spite of advances in technology and increase in the number of wells, production costs are still humongous. Hence, low oil prices will render many fracking operations unviable. True, a Republican house may attempt to re-open Federal land to oil exploration. However, it is unlikely that a "rush for crude" will take place like in 2013 when crude oil prices ruled the roost. Here's another way to look at it: refiners are old money and frackers are new money. Trump, it has to be said, is ferociously old money. Under his presidency, old money will most always wins. Wait and watch. 4. Fast changing geopolitical alliancesPutin likes Trump's style of running business. Like Trump, Putin is an ex CEO who runs his country like one. Putin was one of the firsts to congratulate Trump on his massive win. Indeed, during his campaign Trump praised Putin's strong stance in fighting ISIS. For the first time, a slavic Slovene-born First Lady will be at the White House. Whether she will endeavor to redecorate the place with traditional Russian Babushka dolls remains to be seen. A Russian touch to the American edifice of Democracy, no doubt. More importantly, Melania Trump has played an active role in managing Trump's businesses, and it is reasonable to expect that she will play an active political role, here and abroad, as First Lady. Indeed, there are many aspects in which Trump and Putin see eye-to-eye. This may be surprising as Russia has been America's arch-enemy since the end of WW2, a period spanning 70 years. Bilateral relations between the countries have curdled in recent times with huge open disagreements over Syria. The US has called out Russia's role in Ukraine, while Russia laughed at the US by granting asylum to whistleblower, Edward Snowden. Imagine, then, the surprise in seeing how fast geopolitical alliances change this day. The Brits leaving the EU; Turkey, NATO's second most powerful member power, inking defense and intelligence deals with Russia; the US and Europe arming Al-Qaeda styled militias against a secular regime in Syria. Turkey buying crude oil from (gasp!) ISIS. Brace yourself, the world is in turmoil. We'll see friends and foes of yesteryears interchange in the name of business and necessity. And crude oil of course. 5. New oil pipelines to Europe

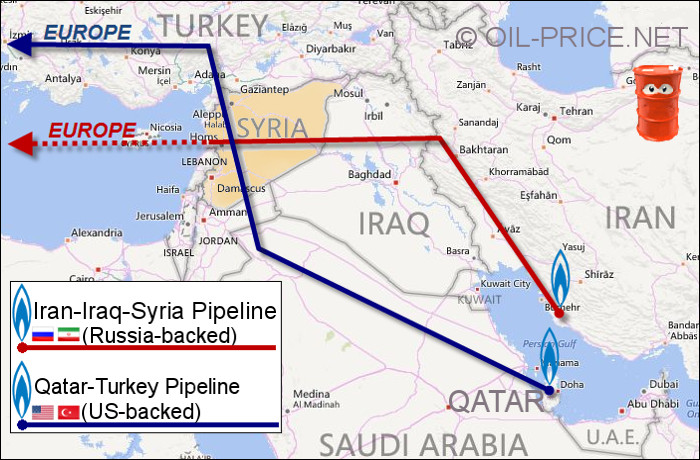

Essentially, the Syrian war was caused by two pipelines.  The proposed Qatar-Turkey pipeline, running through Syria would have affected Russia's role as a supplier of natural gas. Currently a quarter of Europe's gas is supplied by Russia's Gasprom for heating, cooking and other purposes. Not surprisingly, russians desire to maintain their market share. Europe wants to reduce this dependency as capricious Russia had cut-off gas supplies in 2009 over Ukraine gas disputes. The US supports Europe's move on this pipeline. Russia, naturally, isn't pleased. So Syria, which is an ally of Russia, rejected the pipeline. Instead, Syria gave impetus to the Iran-Iraq-Syria pipeline that would have carried gas to Europe bypassing Qatar. Syria thus earned the wrath of Qatar, Turkey, and not to mention the US too. When the gamble is over billions of dollars and a continent's energy dependency, can the means be underestimated? With Trump warming up to Putin, very little stands in the way of the new Russia - Turkey (TurkStream) pipeline transporting natural gas under the Black Sea. The pipeline will help Russia's Gazprom to bypass Ukraine as a transit point. In the wake of recent agreements on discounted gas prices, it remains to be seen how Russia wrestles to profit from the pipeline. Yet, one thing is clear. Once this pipeline is built, natural gas tankers from Qatar transiting through the Suez canal will no longer be financially viable - safe for a steep discount. 6. Europe's leadership declineNow that we have explained Trump's comfy relation with Putin, let's look at the ramifications for Europe. Well, with Putin's energy empire set to tighten its grip on Europe under Trump's presidency, Europe stands to lose. After all, Europe has grown accustomed for the last 70 years to the US taxpayer footing part of its defense bill and that too is about to change. Trump has criticized the low defense spending of NATO's European members during his campaign. He has stated that he would abandon US allies in Europe if they did not spend more on defense. It's nothing short of an epic shift. US-Europe relations will change as well because EU bureaucrats and the American CEO will find it harder to work together. The reasons are pretty obvious as both compete with one another in most markets. Now given Trump's promise of tariffs, export-based economies such as Germany face headwind ahead. Add to this higher military expenditure to stem the migrant crisis and Europe stands to lose influence on the international stage. 7. Emerging marketsEmerging market ETFs have stumbled in the wake of Trump's election. Not for want of reasons, of course. A tight monetary policy with a strong dollar and increase in interest rates will add to the struggle of emerging markets. In truth, the promise of tariffs on Chinese goods, the prospect of lower oil prices, all are detrimental to the outlook of emerging markets. Oil exporting countries like Venezuela that depend on oil revenues for much of their state expenditures will gasp for breath with low oil prices. Low demand, especially in China, is a bad bargain not only for the Asian giant but also other emerging economies. On the other side of the coin, it has to be said, oil importing countries like India and Indonesia stand to gain. 8. Saudi ArabiaThe monarchy of Saudi Arabia was created thanks to Britain's support for Ikhwan wahhabi militias in the 1920s. Boasting an extremist ideology, Ikhwan militias scorned modernization and western ways of life. A 1920s version of ISIS, the Ikhwan bargained violence for land to establish a theocracy. Any opposition was murdered with no mercy. Nearly 100 years later, the Saudi Kingdom is still ruled by the same family but its responsibility in exporting terrorism throughout the world prompts many to re-evaluate the creation of Saudi Arabia. Once prospering on oil exports, the Kingdom, having destroyed OPEC out of sheer arrogance is quickly approaching the edge of insolvency. In a way, Saudi Arabia embodies procrastination: having had over 100 years to diversify its economy but no self-discipline to do so, only a miracle can now save the very pious nation; and Trump surely won't make that happen. Already, Saudi Prince Al- Waleed bin Talal who once called Trump a disgrace and urged him to withdraw from the Presidential race is praising his leadership: "things are very okay right now with Mr. Trump, all the skirmishes and all the misunderstandings will be soon left behind." No country can survive forever with a one-trick pony show and Saudi Arabia is no different. To any President CEO, Saudi Arabia is a poorly run business, with bad business practices. Well, at the rate Saudi Arabia is spending its foreign reserves, the Kingdom will run out of cash within the next four years. That is, before the end of Trump presidency. So, it will most certainly be Trump who will usher in a new leadership re-arrangement in Saudi Arabia - to put it rather mildly. On it, with over 15,000 royals there will be no lack of US-friendly contenders to the Saudi throne. While the end of Saudi Arabia is in the cards and sooner than you might think, one can only guess the ways by which it will happen. Surely ISIS fighters displaced from Syria and Iraq should not be allowed north towards Europe. Already Russian forces have employed the military tactic of "funneling" ISIS south - forcing enemy troops towards a direction instead of destroying them outright. So far it has worked for Russia and if it ain't broke, don't fix it. 9. Middle East influence reversalTrump's promise to disallow Middle-East's influence and bribery on the US political scene gained him huge popular support. As he follows suit on his promise, things are about to change in DC. Whereas previous administrations welcomed Gulf money in Washington, cash payments to influence policy decisions will stop under Trump. With a new US President who has vowed to fight bribery and corruption from the Middle-East, things are about to get competitive in terms of oil and gas too. Undoubtedly, foreign policy with regards to the Middle-East is going to undergo a paradigm shift and Middle-Eastern countries will face political isolation as more oil in the US will reduce - and hopefully revert - the ludicrous power of OPEC countries to dictate terms. ConclusionIrrevocably, the energy sector in the US is off to a fresh start with Trump as the harbinger of a new age. In tandem with oil and gas, you'll see coal making a sort of return to the energy scene. By all likelihood, President Obama's Clean Power Plan to reduce climate change will be thrown off the window. The moratorium on new leases for coal on Federal Lands will be lifted. The coal fired power plants are going to get a new lease of life as Trump is all for fossil fuels. That said the subsidies for renewable could continue as the question is about jobs in the US. If not, some renewables such as solar have come down so much in price recently that they may still be a viable alternative to coal - sans subsidies. On and on, Shale oil boom changed the shape of oil production in the US. Trump's Presidency, with more areas opened for exploration, could mean more supply of oil and gas. When our nine predictions come true, we'll remind you. | ||

|

© oil-price.net 2009, all rights reserved. Permission to redistribute articles from oil-price.net on other sites can be obtained by contacting us. Redistributed articles must contain a copyright notice and a link back to http://oil-price.net as follows:

| ||

|

|