|

|

Language: |

|

|

||||

| |

Russian gas pipelines and hacking the elections

Russia has been in the news lately, amid allegations that it "hacked the vote". Yes, the very 'vote' that granted ascendancy to Trump as the 45th president of America.

What a day January 20 is going to be, so! Many believe that Russia with a volatile, if not belligerent, President aided Trump in no mean measure.

Did Russia shift the scale? Is that even feasible? Well, this and Russia's geopolitical importance in the world energy market are fascinating subjects.

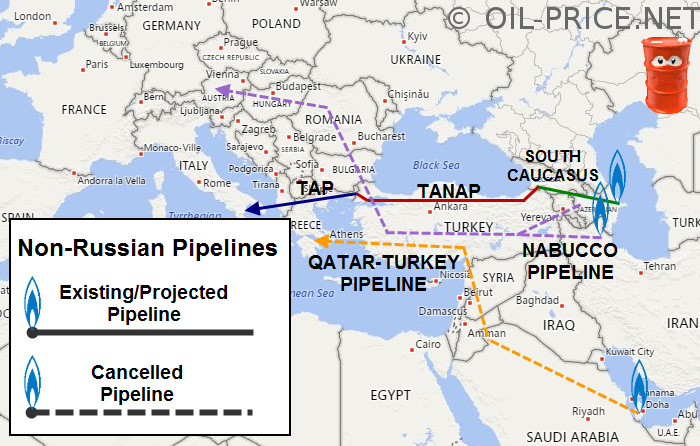

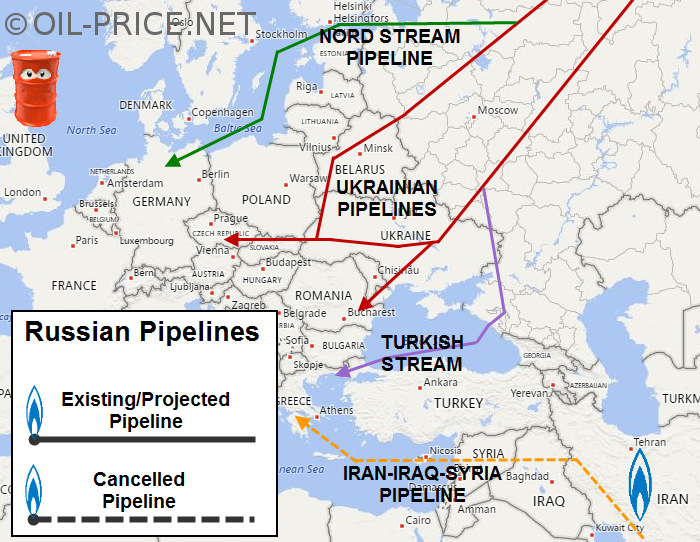

Unfortunately much confusion and misinformation has been spread about what is happening with Russia and where this is headed. Russian bogeymanRussia occupies over 1/8th of all land on Earth. It is the largest country on Earth by far, almost twice the size of the US. It also has the largest known reserves of natural gas with double that of Qatar. Russia is also the second largest crude oil exporter behind Saudi Arabia. Like Saudi Arabia, the Russian state depends on higher oil prices for its funding. Unlike typical Middle Eastern oil producers, Russia also cultivates talent in other industries not the least of which is military equipment. Yet, in contrast with Russia's importance, only 3.6% of Russia's trade occurs with the US. News outlets, aside from recently, are relatively quiet about Russia on a regular basis. Part is due to the legacy of the cold war. Not long ago, historically, everything emanating from Russia - especially ideas - was silenced in the West and it went both ways. Even before that, Russia had very little trade with the Western world due to Russia's long standing occupation by the Mongols/Tatars under whom the Slavs lived as slaves for centuries - no pun intended. The ruling Mongols established trade routes with the Ottoman Empire and Asia and centuries later, modern-day Russia inherited these trading relationships. Russia's "oriental despotism", form of government was also inherited from the Mongols; ironically this style is sometimes copied in Washington circles by high ranking officials dubbed "Czars", for their ability to cut through red tape and get things done. It comes as no surprise, after all, that Putin gets along with some high ranked officials so well. More on this later. Is the tag of 'bully' a fitting portrait for Russian leaders over the years? Well, it takes Czar-minded leaders to hold together such a vast nation neither lacking in crude oil, natural gas or land. However, Russia soon found itself on the receiving side of colonization when Hitler's armies barged in a few centuries later. As it turned out, winter was the wrong time to attack Russia and once Germany was defeated Russia ventured out West for the first time and created a buffer zone - essentially colonizing Eastern Europe. Russia also extended its political influence into western Europe, planting and providing logistical support to then burgeoning socialist parties throughout western Europe, in an unveiled attempt to influence western electoral process. Today these parties are established and shape the (lack of) EU vision. This relationship dynamic with the West, prioritizing geopolitical dominance over trade still exists today under Putin, be it with the control of energy supplies, their routes or influence over the electoral process. Russia's got talentWe mentioned earlier that a major distinction between Russia and Middle Eastern energy producers is Russia's ability to cultivate talent. Indeed Russia does have talent in the realm of science and engineering. Look, until recently Russian chess players were the measure by which IBM's Big Blue supercomputer was evaluated. Professional prospects for this talent within Russia - that's another story. Lack of opportunity in the private sector combined with the high esteem of working for the government gave impetus for Russia's G.R.U. to recruit top talent and mount what the US press dubbed "Election Hacking". Ironically it is the opposite problem which prevented all three-lettered US agencies to protect the nation from "Election Hacking". The flock of talent into the private sector inspired by Silicon Valley successes has made it difficult for US agencies to acquire and retain said talent. This left them no choice but to turn to private contractors. Unfortunately in the aftershock of the Edward Snowden debacle, increased scrutiny has shrunk the pool of qualified applicants. Although "Hacking the Election" is a blanket statement which describes what happened fairly inaccurately, the results are in. More importantly it raises the question of what Russia has to gain from a friendlier White House today? The answer: Russia has come real close to cornering Europe's gas supplies and requires reduced interference from Washington in order to proceed. The story is one of intrigue and clever planning. Let's take a closer look. Non-Russian Gas Pipelines into EuropeIn recent years the US and EU have attempted to create new gas pipelines, on multiple occasions, to help diversify Europe's natural gas away from Russia. This came to a crescendo in 2009 when Russia cut off gas for 13 days without warning following royalty disagreement with Ukraine. It wasn't the first or last time, either. Russia had cut off Ukraine's gas because of price disputes in 2006, repeating the teaser in 2009 and 2014. Within days, several East European countries that were entirely dependent on Russian gas had to stall key industries and declare a state of emergency. Ordinary people bore the brunt because Russia's cameo move came in mid-winter. As a matter of fact, when gas was cut off in 2014, more than half of Ukraine's and all of Slovakia's gas came from Russia. It was a massive and dangerous dependence, to say the least. Naturally, this prompted European powers to consider diversifying away from Russia, encouraged by the US perception of a geopolitical threat in Russian pipelines. Granted its proximity to Europe gives Russia a tremendous logistical advantage over any contending natural gas supplier. There are only a handful of candidates able to satisfy Europe's natural gas needs aside from Russia: Iran, Qatar and Azerbaijan. And so the "Nabucco pipeline" project was born.  NabuccoThe Nabucco pipeline would have transported gas from Caspian states (Iran and Azerbaijan) through Turkey, Hungary, Romania bypassing Russia altogether. It was planned as an alternative route for the thirsty European market. Turkey signed the agreement for the project in 2009. Pegged as a great opportunity, the cost of the pipeline was relatively cheap at 6.2 billion dollars. Originally the planned length was about 3,900 km which was reduced to just 1,300 km later on. With a proposed capacity of 31 billion cubic meters (bcm) per year, Nabucco was funded by European Union and backed by the US. Touted as the 'fourth corridor' of gas transport to Europe, Nabucco, unfortunately failed. Moldering for some time, the project was cancelled by Azerbaijan in 2013 in favor of the Trans Adriatic Pipeline, said to be shorter by 500 km. Southern Gas CorridorTermed the Southern Gas Corridor, SGC is a set of ambitious infrastructure projects conceived to improve energy security and diversification of resources by supplying gas from the Caspian to Europe. Totaling a whopping investment of $45 billion dollars, the initiative stretches across seven countries and 3, 500 kilometres. In other words, it's a complex amalgam of several energy projects like South Caucasus Pipeline, Trans Anatolian Pipeline (TANAP) and Trans Adriatic Pipeline (TAP) Trans Anatolian Pipeline (TANAP)Azerbaijan has more than three trillion cubic metres of gas reserves. Putting these resources to good use, the 1850 km pipeline will carry natural gas from Azerbaijan to Turkey and Europe. A memorandum of understanding (MoU) for the pipeline was signed in 2012 between the governments of Turkey and Azerbaijan and subsequently, construction of TANAP started on March 2015. Europe will get 10 billion bcm of gas a year, while the share of Turkey is expected to be 6bcm of gas. In fact, Turkey can get gas as early as 2018. With an investment of $11.7 billion dollars, the ultimate capacity of TANAP is estimated at 31 bcm. Compared to Nabucco, TANAP was not only shorter but transit countries were smaller, reducing cost and risks involved. This pipeline would enable Turkey to become a prominent player on the gas trade map. Trans Adriatic Pipeline (TAP)The 878 km long, Trans Adriatic Pipeline (TAP) will supply gas from the Shah Deniz 2 field in Azerbaijan to Europe. TAP will connect with TANAP at the Greek- Turkish border and pass through Greece, Albania, and Adriatic Sea before reaching Italy. Construction of TAP started in 2015 and the pipeline is expected to start operation in 2020. However, the timeline also depends on TANAP project which is being delayed. TAP will have 'physical reverse flow' mechanism so that gas could be diverted should there be any disruption. The project has the capacity to transport 10 bcm per year with further potential expansion of 20 bcm a year. South Caucasus pipelineSouth Caucasus pipeline (SCP) is a 629 km long gas exportation pipeline transmitting gas from the Shah Deniz fields in Azerbaijan, through Georgia to Turkey. SCP follows parallel to the Baku- Tbilisi-Ceyhan crude oil pipeline (Incidentally, the Baku-Tbilisi-Ceyhan pipeline was built to counter over dependence on oil from Russia and Iran). In 2016, the daily average throughput was around 20 million cubic metres. Expanding SCP, the South Caucasus Pipeline expansion (SCPX) project was conceived in 2013, while construction began in 2015. SCPX will add another 16 bcma to the existing capacity. Also, as part of SCPX many new facilities like intermediate pigging stations, block valve stations are also being constructed. SCPX will carry natural gas from Russia as well as Central Asia and the Middle East to Southern Europe. Like TANAP, SCPX will start operations in 2019. Qatar-Turkey pipeline and Iran-Iraq-Syria pipelineQatar-Turkey pipeline was a proposed natural gas pipeline transporting the resource in question from South Pars- North Dome Gas fields (Iran and Qatar) to Turkey from where the gas would have eventually reached Europe. The 1500 km pipeline routed through Saudi Arabia, Jordan, Syria and Turkey would have elevated Qatar as a crucial player in the global natural gas market. The reason? Qatar's gas is delivered through tankers which makes it more expensive compared to Russian gas. The pipeline would have made gas from Qatar cheaper. At the same time, the project would have diminished the market share of Russia in European gas imports. Regular readers of oil-price.net know that we have extensively covered these pipelines. As we mentionned in our article titled Oil prices and the Syrian civial war, in 2009 Syrian President Bashar-al-Assad rejected the agreement allowing the 10 billion dollar pipeline to run through Syria to protect the interest of military ally Russia. Instead, in 2012 and under Russia pressure he endorsed the Iran-Iraq-Syria pipeline from Iran to Lebanon passing through Syria. The shift was considerable from Sunni Qatar to Shia Iran. Incidentally, the Syrian civial war erupted with Assad's rejection of the Qatar-Turkey Pipeline. Now both this and the Iran-Iraq-Syria pipelines are unlikely to see the light of day - much like all other non-Russian pipe dreams that were supposed to free Europe from Russia's gas monopoly. European bureaucracy combined with the lack of coordination and leadership among Caspian gas producers has resulted in minimal progress in any of pipelines mentionned above - meanwhile Czar-lead Russian pipelines are steaming ahead. Russia's European pipeline collection

Several key attributes make gas pipelines a valuable strategic asset. For one thing, pipelines bring natural gas long distances very efficiently, much more so than crude oil.

The high viscosity of Crude oil requires heavy pumps and causes significant friction loss, whereas natural gas flows effortlessly with simple pressure differencials. It works so well that gas pipes - a miniature version

of gas pipelines - brings natural gas to most every home.  Ukrainian pipelinesIn 2016, European gas demand increased by around 6% to some 447 bcm. The demand for gas is expected to increase in 2017 because of robust consumption in Italy, France and UK. Close on the heels of OPEC's decision to cut oil production, gas supplies from Russia to Europe are expected to remain vigorous. In this scenario, look at the ground realities: Almost a third of Europe's gas equaling 50% of total gas imports, comes from Russia, of which, 40% comes in through Ukraine. Europe just can't afford to let such a large share of its gas transit through the Ukrainian warzone. So, pipelines bypassing Ukraine altogether come into the picture eliminating the country's role as a major transit zone, with blessings of both the EU and Russia. Nord Stream PipelineThis gas pipeline, with two parallel lines, carries Natural Gas from Russia directly into Germany via Baltic Sea. Though it has the ability to deliver 55 billion cubic metres per year, the gas supplied in 2015 amounted to just about 39 billion cubic metres. According to our latest data, the pipeline supplies more than 150 million cubic metres of gas per day . Being shorter, the gas pipeline is very cost effective, so it's hard for any other foreign power (such as Qatar) to build a competing pipeline into Western Europe that would be cheaper. The multi-billion dollar Nord Stream 2, with two pipelines, is scheduled for 2019. Each will carry 27.5 bcm per year. Nord Stream and Nord stream 2 will thus supply a total of 110 billion cubic metres per year of gas across the Baltic Sea to the European Union. Turkish StreamTurkish stream, in short, is a chess master's dream. In the last month of 2014, Russia abandoned the South Stream pipeline project after disagreements with the EU. In a spectacular turn around, Russia went in for the jugular. So, instead of South Stream, work on two pipeline strings running under the Black Sea carrying 64 billion cubic feet of gas was taken up, after a meeting between Putin and Turkish President Tayyip Erdogan. In fact, the pipes and other infrastructure parts ordered for the South Stream project was diverted to the Turkish Stream. The sea section alone is set to cost Russia about 7 billion Euros. The pipe laying under the Black Sea is scheduled for late 2017. The first string of the project would supply gas to Turkey, while the second string would carry gas to Europe. Also, the south Balkan pipeline which delivers Russian gas to Turkey via Ukraine will be made redundant by the first string of the project. This is a significant strategic victory for Russia. Gazprom, will have rights to the sea part of the project, while the land stretch will be owned by Turkish customers in the first leg and by a joint venture in the second leg. So, Turkey would collect royalties on gas going into Europe to the dismay of Bulgaria, losing royalties, transit revenues and strategic advantage to its former Ottoman overlord. Indeed, Moldova and Romania too lose out in terms of transit fee. Turkish Stream's main objective is for Russia to bypass existing Ukrainian gas routes. At any rate, Russian target is to stop all gas transport through Ukraine by 2019. And, thanks to the Turkish stream, redundant with existing pipelines, Russia can "diversify" its gas pipelines, thus cornering the European market and delivering gas directly into Europe. Revenue from export duties will benefit Russia too. It also cements economical and strategic ties between Russia and Turkey which will control gas route into Europe while getting its own gas at a 10% discount. That's a blessing because Turkey relies on natural gas for 50% of its electricity generation. Russia and Turkey have also stepped up partnership in defense in the area of anti-missiles. Furthermore, Russia will also build Turkey's first nuclear power plant. With NATO allies like Turkey, who needs enemies? Apparently prediction #4 which we made in our previous article titled 9 oil price forecasts during Trump presidency" has already realized, a mere two weeks into the new year. Turkey not only gets 60% of its gas, but also more than 30% of its crude oil from Russia. For Turkey, this is a major achievement to show the world that it has the guts to implement major projects without support from Europe. Further, it strengthens Turkey's geopolitical aspirations in the region. In addition, Turkish stream aligns Russia and Turkey's interest and dissuades Turkey from building a pipeline to Qatar via Iraq which would have fed into Europe and sap Russia's market share. Of course, Turkish Stream's 63 billion capacity outdoes the expected demand in the area. However, the moot point is different. It's the story of winner gets all. Russia, thus, directly competes with Europe's plan to diversify away from Russia. It also sabotages Iran's aspiration for a pipeline. ConclusionPutin sits pretty. US secretary of state is Exxon's CEO Tillerson, a friend of Putin. Michael Finn, the proposed national security adviser is a strong advocate of Russia. The Russian President has tons of influential friends in Washington, ready to sway things in his favor. In the coming months, US support for energy diversification in Europe will erode quickly, branding the renewal of US-Russia ties as a priority over interfering in foreign energy markets. US progress towards energy self-sufficiency in the sight of persistently low oil prices has also reduced geopolitical concerns over control of foreign energy sources. So it comes as no surprise that the US has started a reform to drastically reduce its Strategic Petroleum Reserve (SPR). Slowly but surely, Russia has laid the groundwork for dominance over the European energy market. For now, Russian ploy seems to be working well. And, Washington has been reined in too. The southern Gas corridor could well be the tipping point. On target, Russian monopoly on natural gas is set. The big question is, what next? | ||

|

© oil-price.net 2009, all rights reserved. Permission to redistribute articles from oil-price.net on other sites can be obtained by contacting us. Redistributed articles must contain a copyright notice and a link back to http://oil-price.net as follows:

| ||

|

|